Category: Business

From Relaxation to Recovery – How Massage Services Improve Physical and Mental Health

In today’s fast-paced world, where stress, anxiety, and physical tension have become a part of everyday life, massage therapy emerges as a powerful and essential practice to promote overall well-being. The therapeutic touch of a skilled massage therapist not only relaxes the body but also calms the mind, creating a holistic experience that rejuvenates and restores balance. Beyond the immediate feeling of relaxation, massage therapy offers numerous physical, mental, and emotional benefits that contribute to long-term health and vitality. Physically, massage therapy works wonders in alleviating muscle tension, reducing pain, and improving flexibility. Whether it is from prolonged sitting, rigorous exercise, or everyday strain, muscles often develop tightness and knots that can lead to discomfort. Regular massage sessions help release these knots, improve blood circulation, and enhance the flow of oxygen and nutrients to tissues. This not only promotes faster healing but also prevents injuries by maintaining muscle elasticity and joint mobility.

Moreover, massage therapy can be particularly beneficial for people suffering from chronic pain conditions such as arthritis, fibromyalgia, or lower back pain by providing natural pain relief and reducing inflammation. On a mental and emotional level, massage therapy plays a crucial role in reducing stress and promoting relaxation. The act of touch stimulates the production of serotonin and dopamine neurotransmitters responsible for feelings of happiness and well-being while reducing the levels of cortisol, the stress hormone. This biochemical response helps alleviate anxiety, depression, and mood disorders, making massage therapy a valuable addition to any mental health regimen. In a world where mental health is becoming an increasing concern, incorporating massage therapy into one’s self-care routine can significantly improve emotional resilience and overall mood. Moreover, massage therapy enhances the quality of sleep by promoting relaxation and reducing insomnia. Many individuals struggle with sleep disturbances due to stress or physical discomfort, and massage helps by encouraging the body to enter a state of deep relaxation. Improved sleep patterns, in turn, contribute to better cognitive function, increased energy levels, and a stronger immune system.

When the body is well-rested, it can better defend itself against illnesses and maintain optimal functioning. Another often-overlooked benefit of massage therapy is its positive impact on the body’s lymphatic system, which is responsible for eliminating toxins and waste. Through gentle, rhythmic movements, massage helps stimulate lymphatic drainage, promoting detoxification and enhancing the immune response. This detoxification process not only boosts overall health but also leaves individuals feeling refreshed and revitalized. In addition to its physical and emotional benefits, massage therapy fosters a deep connection between the mind and body. This heightened awareness encourages individuals to become more attuned to their body’s signals, leading to better self-care practices and healthier lifestyle choices. As people become more mindful of their physical and emotional well-being, they are empowered to make decisions that enhance their overall quality of life. 출장 홈타이 massage therapy is far more than a luxury or an occasional indulgence. It is a vital tool for maintaining and improving physical, emotional, and mental health. By incorporating regular massage sessions into one’s wellness routine, individuals can experience profound benefits that extend beyond relaxation.

Explore Diverse Paths Apply to Growing Companies

In the dynamic landscape of innovation, there exists a beacon illuminating the path to the future. That beacon is our startup, a nexus of creativity and ambition, inviting visionary talent to join us in shaping tomorrow’s world. We are not just another venture; we are the architects of transformation, poised at the intersection of technology and imagination. Our mission is clear: to revolutionize the way we live, work, and connect. At the heart of our endeavor lies a commitment to disruptive innovation. We refuse to be confined by convention; instead, we thrive on challenging the status quo. Every member of our team is a pioneer, driven by an insatiable curiosity and a relentless pursuit of excellence. Together, we cultivate an environment where ideas are born, nurtured, and set forth to change the world. What sets us apart is not just our ambition, but our unwavering belief in the power of collaboration. We are a mosaic of diverse talents, united by a shared vision and a collective passion for innovation.

Here, your voice is not just heard; it is amplified. Your ideas are not just welcomed; they are celebrated. In our ecosystem of creativity, there are no boundaries, only endless possibilities waiting to be explored. As we embark on this journey of transformation, we seek individuals who dare to dream big, who are not afraid to challenge the norm, and who are driven by a hunger to leave a mark on the world. Whether you are a seasoned professional or a fresh graduate, if you possess the fire in your belly and the spark in your mind, we want you to join our ranks. What awaits you is more than just a job; it is an adventure.

You will be part of a close-knit community of innovators, mentors, and collaborators, where every day presents an opportunity to learn, grow, and push the boundaries of what is possible. Here, failure is not feared but embraced as a stepping stone towards success. We understand that the path to greatness is paved with challenges, and we face them head-on, together. Joining our startup means becoming part of something bigger than you. It means contributing to a legacy that transcends generations, leaving an indelible imprint on the fabric of history. Together, washington dc jobs hiring we will redefine the way we live, work, and interact with the world around us. Together, we will shape the future. So, if you are ready to embark on a journey of innovation, if you are ready to unleash your vision and be part of something extraordinary, then we invite you to join us. Together, let us dare to dream, let us dare to innovate, and let us dare to change the world. The future waits, and it begins with you.

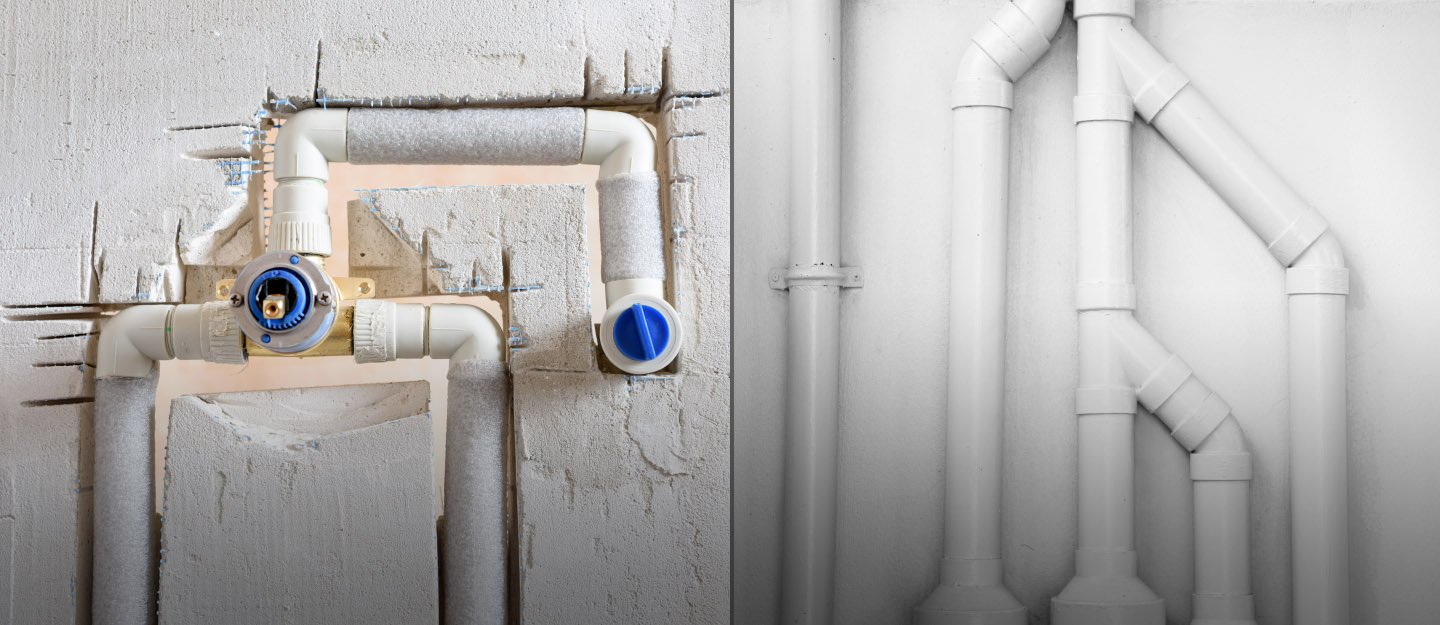

Trader’s Paradise – Explore the Widest Range of GI Pipes for Every Project Requirement

In the bustling world of construction and infrastructure development, the backbone of many projects lies in the robustness and reliability of GI pipes. Whether it is for plumbing systems, irrigation networks, or structural frameworks, GI pipes serve as indispensable components. Amidst the vast array of options available, finding the perfect fit for every project requirement can be a daunting task. However, with Trader’s Paradise, navigating through this realm becomes a seamless journey. Offering the widest range of GI pipes, Trader’s Paradise stands as the ultimate destination for fulfilling diverse project needs.

Unraveling the Diversity:

At Trader’s Paradise, diversity is not just a buzzword but a cornerstone of their offerings. From varying diameters to different thicknesses, the range of GI pipes available caters to every imaginable requirement. Whether it is a small-scale residential plumbing project or a large-scale industrial endeavor, Trader’s Paradise ensures that no project is left without the perfect GI pipe solution.

Quality Assurance:

In the realm of construction, compromise is not an option when it comes to quality. Understanding this principle, Trader’s Paradise places utmost emphasis on quality assurance. Each GI pipe undergoes rigorous testing procedures to ensure compliance with industry standards. This commitment to quality not only instills confidence in customers but also ensures the longevity and reliability of every project where Trader’s Paradise GI pipes are employed.

Custom Solutions:

Recognizing that one size does not fit all, Trader’s Paradise goes a step further by offering custom solutions. Whether it is a unique diameter requirement or specific coating specifications, Trader’s Paradise collaborates closely with customers to deliver tailor-made GI pipe solutions. This bespoke approach not only streamlines project execution but also enhances efficiency and effectiveness, ultimately leading to superior project outcomes.

Durability and Longevity:

In the realm of construction materials, durability is paramount. G I pipes from Trader’s Paradise are engineered to withstand the test of time. Whether it is exposure to harsh weather conditions or corrosive elements, these pipes exhibit unparalleled resilience, ensuring long-term structural integrity for every project they are incorporated into. With Trader’s Paradise GI pipes, durability is not just a feature but a guarantee.

Technical Expertise:

Navigating through the myriad of GI pipe options can be overwhelming, especially for those unfamiliar with the technical nuances. However, at Trader’s Paradise, customers are not left to fend for themselves. With a team of seasoned professionals possessing deep expertise in the field, Trader’s Paradise provides invaluable guidance and technical support at every step of the way. From product selection to installation, customers can rely on Trader’s Paradise for comprehensive assistance, ensuring a smooth and hassle-free experience.

In the dynamic landscape of construction and infrastructure development, the significance of reliable GI pipes cannot be overstated. With Trader’s Paradise, the quest for the perfect GI pipe solution culminates into a journey marked by diversity, quality, customization, durability, and technical expertise. As projects continue to evolve and diversify, Trader’s Paradise remains steadfast in its commitment to providing the widest range of GI pipes, catering to every project requirement with unwavering excellence. Embark on your journey to excellence with Trader’s Paradise where every project finds its perfect pipe.

Best Psychology behind Students Seeking Essay Writing Assistance

The increasing prevalence of students seeking essay writing assistance reflects a complex interplay of psychological, academic, and societal factors. At its core, the pursuit of such services often stems from the mounting pressure and expectations placed on students in today’s highly competitive educational landscape. Students, facing a myriad of academic challenges, may turn to essay writing assistance as a coping mechanism to manage the overwhelming workload and the desire to excel academically. One significant psychological factor contributing to this trend is the fear of failure. In an environment that places a premium on academic success, students may experience heightened anxiety about their performance. The fear of not meeting expectations, whether self-imposed or imposed by external factors, can drive students to seek external help as a means of ensuring the desired outcomes. The desire for validation and the avoidance of potential academic setbacks create a psychological push for students to resort to essay writing services.

Moreover, the modern educational system, characterized by tight deadlines and a multitude of assignments, contributes to the demand for external assistance. The constant juggling of multiple responsibilities and the need to excel in various subjects can overwhelm even the most diligent students and check over here. As a result, seeking essay writing help becomes an appealing option for those who find themselves stretched thin, providing a way to alleviate the stress associated with academic demands. The ease of access to online essay writing services also plays a pivotal role in the growing trend. The digital age has made it effortless for students to connect with professional writers and services, creating a tempting shortcut to academic success. The anonymity provided by online platforms may embolden students to seek assistance without the fear of judgment from peers or instructors, further fueling the demand for such services.

Additionally, the perception of success as a linear path defined solely by academic achievements contributes to the inclination to seek external assistance. Students may view essay writing services as a means to streamline their academic journey, potentially freeing up time for other pursuits or addressing personal challenges. The societal emphasis on academic performance as a key determinant of future success can foster a mindset that justifies seeking help to meet these expectations. While the motivations behind seeking essay writing assistance are multifaceted, it is essential to recognize the potential consequences. Ethical concerns, academic integrity, and the long-term impact on a student’s ability to develop crucial skills are important considerations. Institutions and educators need to foster an environment that encourages open communication about the challenges students face, addressing the root causes of academic stress, and providing support systems that promote genuine learning and personal growth.

Your Vision, Your Business – Embrace Small Business Ownership

In a world where individuality and entrepreneurship are increasingly valued, the vision of embracing small business ownership has never been more relevant. Small businesses represent the backbone of local economies, fostering innovation, creativity and community engagement. At the heart of this vision is the belief that anyone with passion, determination and a unique idea can create a successful enterprise, irrespective of their background or financial status. The journey of small business ownership begins with a vision, a dream that ignites a spark within an individual’s soul. This vision is the driving force behind countless late nights, ambitious plans and unwavering determination to bring an idea to life. Unlike traditional career paths, small business ownership offers the freedom to shape one’s destiny, paving the way for personal growth and fulfillment. It provides a platform for individuals to utilize their talents, skills and passions in a way that aligns with their values, making it a profoundly rewarding endeavor.

Embracing small business ownership also involves taking calculated risks. It requires courage to step out of the comfort zone and face uncertainties, but it is these risks that can yield the greatest rewards. From the initial investment to overcoming inevitable challenges, small business owners learn to embrace failure as a stepping stone towards success. The lessons learned along the way foster resilience and adaptability, crucial traits that drive growth and sustainability in the ever-changing business landscape. Moreover, small businesses serve as vital cornerstones of local communities i thought about this. They contribute to economic growth, create jobs and invest in the welfare of their neighborhoods. By providing personalized products and services, small business owners build strong relationships with their customers, fostering a sense of trust and loyalty. These connections go beyond mere transactions; they create a sense of belonging and shared purpose, supporting the establishment of vibrant and thriving communities.

In the digital age, small business ownership has been further empowered by technological advancements. Online platforms, social media and e-commerce enable entrepreneurs to reach a global audience from the comfort of their homes. This democratization of business has opened up new opportunities for diverse voices to be heard, creating a richer and more inclusive marketplace. However, embracing small business ownership also comes with its challenges. Competing with larger corporations and navigating regulatory landscapes can be daunting. Still, the resilience and agility of small businesses often enable them to pivot swiftly and adapt to changing circumstances. Moreover, with the rise of conscious consumerism, more people are actively seeking out and supporting local businesses, recognizing the positive impact they have on their communities and the environment. In conclusion, the vision of embracing small business ownership embodies the spirit of individuality, creativity and community. It celebrates the power of human potential and the capacity to turn dreams into reality. Small businesses not only drive economic growth but also enrich the social fabric of society, fostering a sense of belonging and pride.

What Are the Challenges Facing Birmingham’s Haulage Company?

Birmingham’s haulage companies play a crucial role in the transportation of goods, serving as a vital link between suppliers, manufacturers and consumers. However, like any industry, the haulage sector is not without its challenges. This article aims to explore some of the key obstacles facing Birmingham’s haulage companies today and how they can navigate the road ahead.

Evolving Regulatory Landscape:

One of the significant challenges for haulage companies in Birmingham is navigating the evolving regulatory landscape. Regulations surrounding road safety, emissions and working hours continue to change, requiring companies to adapt and comply with new standards. This poses a challenge in terms of ensuring drivers are trained and equipped with the knowledge to meet these evolving requirements, as well as investing in modernizing fleets to meet stricter emissions standards.

Driver Shortage:

A shortage of skilled drivers is a pressing issue faced by many haulage companies in Birmingham. Factors contributing to this shortage include an aging workforce, difficulties in attracting younger generations to the profession and increased competition for qualified drivers. The shortage not only affects the operational capacity of haulage companies but also places upward pressure on wages, leading to increased costs for businesses. To address this challenge, haulage companies must focus on improving recruitment strategies, offering competitive compensation packages and providing ongoing training and career development opportunities. Collaborating with educational institutions and industry associations to promote the profession and attract new talent can also help mitigate the driver shortage.

A shortage of skilled drivers is a pressing issue faced by many haulage companies in Birmingham. Factors contributing to this shortage include an aging workforce, difficulties in attracting younger generations to the profession and increased competition for qualified drivers. The shortage not only affects the operational capacity of haulage companies but also places upward pressure on wages, leading to increased costs for businesses. To address this challenge, haulage companies must focus on improving recruitment strategies, offering competitive compensation packages and providing ongoing training and career development opportunities. Collaborating with educational institutions and industry associations to promote the profession and attract new talent can also help mitigate the driver shortage.

Rising Fuel Costs:

Fluctuating fuel costs pose a significant challenge to Birmingham’s haulage companies. Fuel prices are subject to geopolitical factors, global market dynamics and environmental regulations, making them volatile and unpredictable. As fuel costs rise, it directly impacts the bottom line of haulage companies, leading to increased operational expenses and reduced profitability. To mitigate the impact of rising fuel costs, haulage companies should explore fuel-efficient technologies, such as hybrid or electric vehicles and invest in driver training programs that emphasize fuel-efficient driving techniques. Implementing route optimization software can also help minimize fuel consumption by optimizing delivery routes and reducing unnecessary mileage.

Infrastructure and Congestion:

Birmingham’s haulage companies face the challenge of navigating congested road networks and inadequate infrastructure. Traffic congestion not only results in delays and increased fuel consumption but also affects overall operational efficiency. As urban areas expand and e-commerce continues to grow, the strain on existing infrastructure becomes more pronounced. To address these challenges, haulage in Birmingham can collaborate with local authorities to advocate for infrastructure improvements, including expanded road capacity, optimized traffic management systems and the development of dedicated freight corridors. Additionally, utilizing real-time traffic data and intelligent routing software can help drivers avoid congested areas and minimize delays.

Technological Advancements:

The rapid pace of technological advancements presents both opportunities and challenges for haulage companies. While technologies such as telematics, GPS tracking and warehouse automation can enhance operational efficiency, their implementation and integration require significant investment and training. Haulage companies need to stay abreast of emerging technologies and evaluate their potential benefits. Strategic adoption of technologies that align with the company’s objectives can streamline processes, improve communication and enhance customer service. However, it is essential to consider the upfront costs, implementation challenges and ongoing maintenance requirements associated with adopting new technologies.

Conclusion:

Birmingham’s haulage companies face a multitude of challenges in today’s ever-changing business landscape. From navigating evolving regulations to addressing the driver shortage, rising fuel costs, infrastructure constraints and technological advancements, these hurdles require careful planning and proactive measures. By embracing innovative strategies, investing in driver recruitment and training, adopting fuel-efficient technologies, advocating for improved infrastructure and selectively adopting technological advancements, Birmingham’s haulage companies can overcome these challenges.

The varied process to popularize the property sale

There are varied processes for selling the house. Irrespective of the condition for selling the house. There is a varied sources through which the motive seller can be seen and one such website is https://www.propertyleads.com/motivated-seller-leads/motivated-seller-leads-maine/ which makes it easier to buy the property much easier way.

Varied ways to sell:

The motivated seller can sell the house in a much more convenient process. This varied way makes the seller find the potential buyer quickly and conveniently complete the deal. They can also invest in the return-based service which will be able in the post office. In case the owner of the house gets the shift to the new location there is also possible to get the new address to get the latest updates related to the property.

If the seller is a solopreneur who is facing a tight budget they may use the facility of direct mail form of printed materials as well as the fill envelopes along with the mail postcards. This is the way to proceed in the selling process of the property.

The motivated seller also started to have a toll-free number or event can visit their website to have the detail about the selling process of their property or house. There is also an option to schedule a phone call where the customer can find the varied type of property which is meant for sale.

Sending the letter as well as the varied attractive postcard would lead to attractive buyer and find the potential buyer of the property.

The website will give the details related to the reason for selling the property. The number of years the owner lived in the house and the customer can also mention the type of property they would like to opt for, whose name is the title, and varied improvement that is done for the Maintenance of the property or house can be seen on the website.

At this stage, the task of the house owner is not to sell the house but initially listen as well as to gather varied information to develop rapport. The more the customer listens to the seller they get to educate about the house seller.

Detailed Information on Small Business Valuation and its Benefits

Small business valuation is the process of determining the worth of a company. This valuation can be done for various reasons, such as selling the business, obtaining financing, estate planning, or understanding the business’s financial health. Valuation is an essential tool for small business owners as it provides a snapshot of the company’s current value, allowing them to make informed decisions about their business’s future.

Valuation methods can vary depending on the industry and the business’s size, but there are three main approaches: asset-based, income-based, and market-based. Asset-based valuation looks at the company’s assets and liabilities, with the difference between the two being the company’s net worth. This method is best suited for businesses that have significant tangible assets, such as real estate, inventory, or equipment. Income-based valuation uses the company’s future earnings potential as a basis for valuation in best site. This approach is more suited for service-based businesses that rely on intangible assets, such as intellectual property or brand recognition. Market-based valuation looks at the company’s value relative to similar businesses in the industry. This approach is best suited for companies that are publicly traded or have a strong presence in the market.

Benefits of Small Business Valuation

Setting a Price for Selling the Business

One of the most common reasons for small business valuation is to set a price for selling the business. Business owners can use the valuation to determine a fair market price for their business. Valuation can also help business owners to identify potential areas of improvement to increase their business’s value before selling it.

Obtaining Financing

Small business valuation can be useful for obtaining financing. Financial institutions, such as banks or venture capitalists, may require a business valuation before approving a loan or investing in the business. A high valuation can also help a business owner to negotiate better loan terms and interest rates.

Estate Planning

Small business valuation is essential for estate planning, especially when the business is a significant portion of the estate. Valuation can help business owners to determine the worth of the business and plan for succession. A business owner may also use valuation to distribute assets fairly among beneficiaries.

Understanding the Business’s Financial Health

Small business valuation provides a snapshot of the business’s current financial health. By assessing the company’s value, business owners can identify potential areas of improvement, such as reducing expenses, increasing revenue, or improving the business’s operations. Valuation can also help business owners to identify whether their business is in a healthy financial position to expand, merge with another company or sell.

Employee Compensation

Small business valuation can be used to determine employee compensation. Valuation can help business owners to assess the business’s financial position and identify how much they can allocate to employee salaries and benefits. A high valuation may also help business owners to attract and retain top talent by offering competitive compensation packages.

Legal Proceedings

Small business valuation may be required for legal proceedings, such as a divorce or a shareholder dispute. In such cases, valuation can help determine the value of the business and ensure a fair division of assets or compensation.

Tax Planning

Small business valuation is essential for tax planning. Business owners can use valuation to determine the business’s fair market value, which can be used to calculate tax liabilities, such as capital gains tax or estate tax.

Conclusion

Small business valuation is an essential tool for business owners to assess their business’s financial health, plan for the future, and make informed decisions. Valuation methods vary depending on the industry and the business’s size, but the three main approaches are asset-based, income-based, and market-based. Benefits of small business valuation include setting a price for selling the business, obtaining financing, estate planning, understanding the business’s financial health, employee compensation, legal proceedings, and tax planning.